39 us treasury bonds coupon rate

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S....

How Are US Treasury Bonds Taxed? - Netcials Gains on bonds are taxable provided the discount is greater than something called "De Minimis Threshold". To find the threshold, just take the term of maturity and multiply it by 0.25. In the case of US treasury bonds, the usual maturity term is 30 years. Thus de minis threshold for treasury bonds = 30 years x 0.25 = 7.5%

Us treasury bonds coupon rate

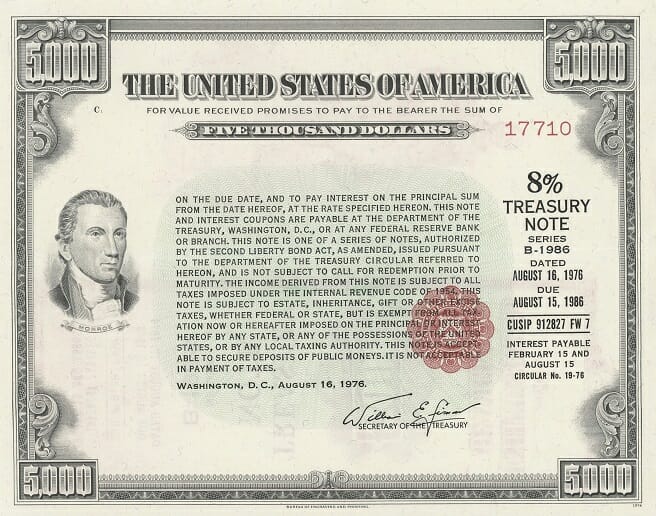

TMUBMUSD20Y | U.S. 20 Year Treasury Bond Overview | MarketWatch Investors seeking safety from inflation flock to 20- and 30-year Treasury bonds; yields fall by 10 basis points each to around 3.5% and 3.3%, respectively. Jun. 17, 2022 at 11:55 a.m. ET by Vivien ... US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

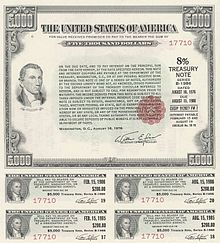

Us treasury bonds coupon rate. Are most US treasury bonds which pay coupons of fixed interest rates ... Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: Bonds that mature in a year or less (called Treasury "Bills"). Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.752% yield. 10 Years vs 2 Years bond spread is -72.7 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.00% (last modification in November 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

Bonds | FINRA.org Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. ... Treasury Bond A Treasury bond is a long-term debt security issued by the U.S. government with a maturity of 10 to 30 years, paying a fixed interest rate ... United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year Treasury Bonds — TreasuryDirect EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. For information, see U.S. Savings Bonds. Bonds at a Glance Latest Rates 20 Year Bond 3.375% Issued 09/30/2022. Price per $100: 93.835989. CUSIP 912810TK4. 30 Year Bond 3.000% Issued 09/15/2022. Price per $100: 90.579948. CUSIP 912810TJ7. See All Rates How do I ... for a bond United States Treasury 2-Year Note 0.125% Nov 30, 2022 View the 91282CAX92 bond market news, real-time rates and trading information. Complete United States Treasury 2-Year Note 0.125% Nov 30, 2022 bonds overview by Barron's. ... Coupon Rate 0.125% ...

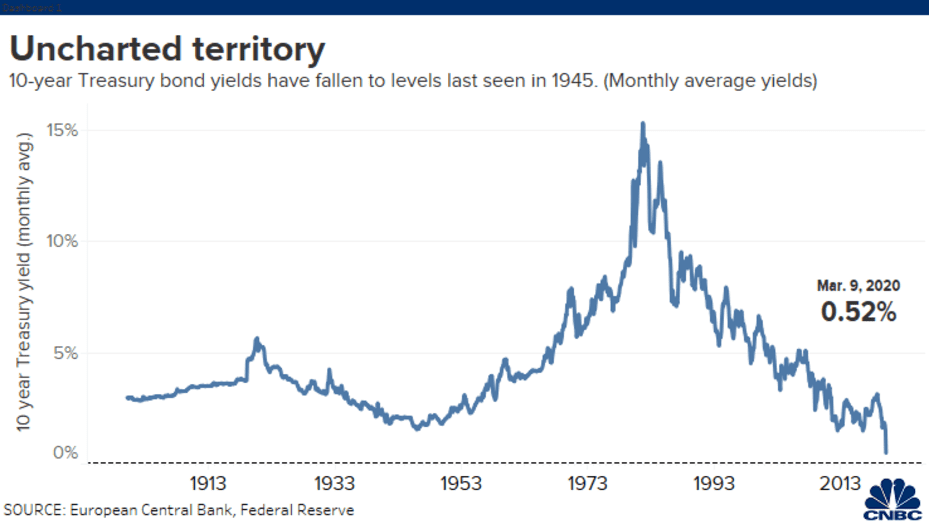

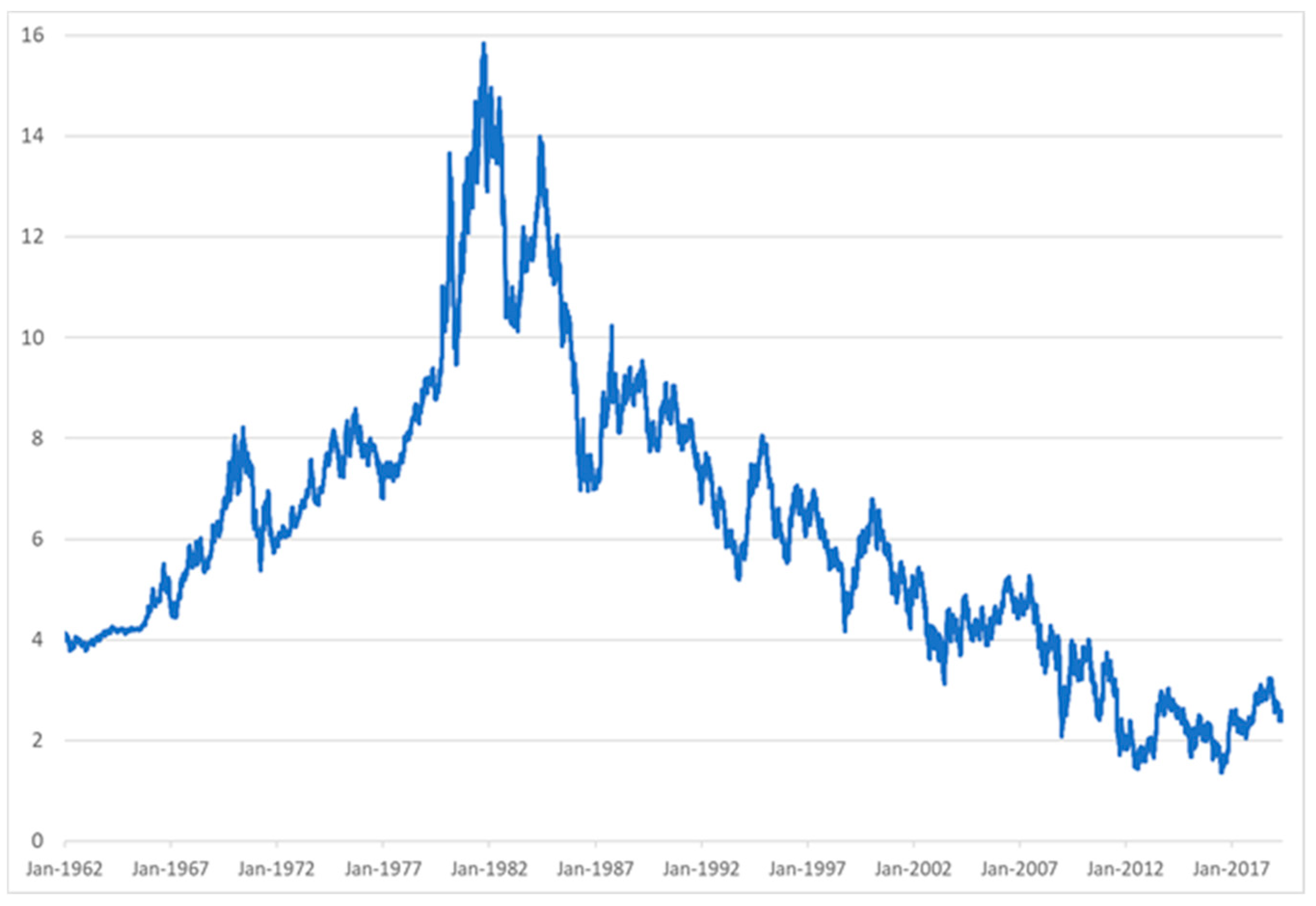

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.75%, compared to 3.69% the previous market day and 1.52% last year. This is lower than the long term average of 4.26%. Stats Related Indicators Treasury Yield Curve How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. ... The coupon rate can vary depending upon the structure of the ...

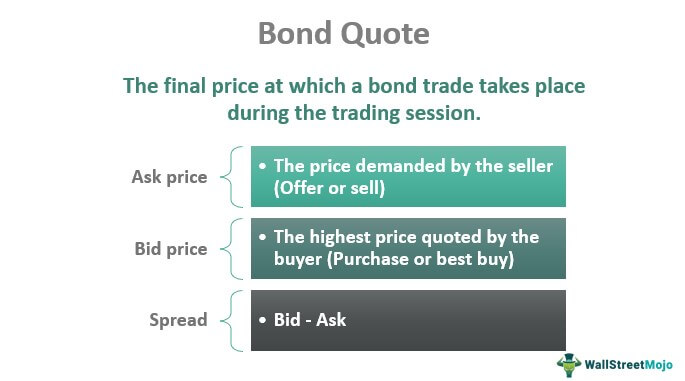

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the bond is the same as the face value.

Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Now, what if you bought the security in the secondary market?

Understanding Treasury Bond Interest Rates | Bankrate Let's run through an example of how Treasury bonds work and what they could pay you. Imagine a 30-year U.S. Treasury Bond is paying around a 3 percent coupon rate. That means the bond...

TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview | MarketWatch Coupon Rate 4.500% Maturity Nov 15, 2025 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Aggressive Treasury selloff pushes 2- and 3-year yields above 4.3% in...

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes

Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more...

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out...

Continued Treasury Zero Coupon Spot Rates — TreasuryDirect 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the Selected Asset and Liability Price Report under Spot (Zero Coupon ...

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

TMUBMUSD20Y | U.S. 20 Year Treasury Bond Overview | MarketWatch Investors seeking safety from inflation flock to 20- and 30-year Treasury bonds; yields fall by 10 basis points each to around 3.5% and 3.3%, respectively. Jun. 17, 2022 at 11:55 a.m. ET by Vivien ...

Post a Comment for "39 us treasury bonds coupon rate"