42 what is coupon for bond

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Chapter 10: Review five major bond characteristics What is the ... What is the difference between zero coupon bonds, treasury strips, and junk bonds? How is the investment quality of a bond determined? GET AN ESSAY WRITTEN FOR YOU FROM AS LOW AS $13/PAGE. Order Essay. Maturity. This is the date when the bond's principal amount will be paid to the company's investors. Payment will end the bond obligation of ...

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow WebDec 10, 2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the coupon …

What is coupon for bond

en.wikipedia.org › wiki › James_BondJames Bond - Wikipedia Fleming endowed Bond with many of his own traits, including sharing the same golf handicap, the taste for scrambled eggs, and using the same brand of toiletries. Bond's tastes are also often taken from Fleming's own as was his behaviour, with Bond's love of golf and gambling mirroring Fleming's own. Fleming used his experiences of his career in ... › terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are... James Bond - Wikipedia WebIan Fleming created the fictional character of James Bond as the central figure for his works. Bond is an intelligence officer in the Secret Intelligence Service, commonly known as MI6.Bond is known by his code number, 007, and was a Royal Naval Reserve Commander.Fleming based his fictional creation on a number of individuals he came …

What is coupon for bond. Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia WebMay 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebThe coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, › terms › cCoupon Bond: Definition, How They Work, Example, and Use Today Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What are Zero-coupon Bonds? Price of the zero coupon bond = Face Value/1/ (1+r) ^n Where 'r' is the implied interest rate and 'n' is the period to maturity. Face value is the maturity value of the bond. If zero coupon bonds are compounded twice a year, then the formula would be: Price of the zero coupon bond = Face Value/1/ (1+r/2) ^ (2n) What Is a Bond Coupon, and How Is It Calculated? - Investopedia WebApr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Bond: Definition, How They Work, Example, and Use Today WebMar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Treasury Coupon Issues | U.S. Department of the Treasury Web"The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

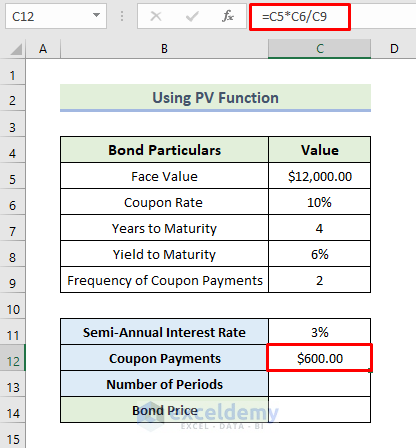

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ WebUsing the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Bond: Financial Meaning With Examples and How They Are Priced WebJul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

What is coupon bond or coupon payment? | Invest Carrier A coupon bond or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from the issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a year divided by the face value of the bond in question).

What is coupon on bonds? - moneycontrol.com The coupon rate is the annualised interest amount. Coupon rate is calculated by taking the annual coupon payment and dividing it by the bond's face value. For instance, if you have a...

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Answered: What is the coupon rate for a bond with… | bartleby The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA What is Coupon Bond? The term "coupon bond" (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond. These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance.

Bond Yield Calculator – Compute the Current Yield - DQYDJ WebBond Face Value/Par Value ($) - The par value or face value of the bond. Years to Maturity - The numbers of years until bond maturity. (You can enter decimals to represent months and days.) Annual Coupon Rate - The interest rate paid on the bond. Coupon Payment Frequency - How often the interest is paid out on the bond. Bond Yield Calculator ...

James Bond - Wikipedia WebIan Fleming created the fictional character of James Bond as the central figure for his works. Bond is an intelligence officer in the Secret Intelligence Service, commonly known as MI6.Bond is known by his code number, 007, and was a Royal Naval Reserve Commander.Fleming based his fictional creation on a number of individuals he came …

› terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are...

en.wikipedia.org › wiki › James_BondJames Bond - Wikipedia Fleming endowed Bond with many of his own traits, including sharing the same golf handicap, the taste for scrambled eggs, and using the same brand of toiletries. Bond's tastes are also often taken from Fleming's own as was his behaviour, with Bond's love of golf and gambling mirroring Fleming's own. Fleming used his experiences of his career in ...

Post a Comment for "42 what is coupon for bond"