39 treasury bill coupon rate

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury bill coupon rate

Current Treasury Bill Rate In Ghana (May 2022 Update) By Bank … 13.05.2022 · 91-Day 0r 3 month Treasury Bill. 182-Day or a 6 month Treasury Bill. 365-Day or 1 year Treasury Bill. For you to know how much interest can you earn from a treasury bill, you need to know the interest rate.. You need to take note of these forms of investment since the rate of interest on the principal amount may not be huge. India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

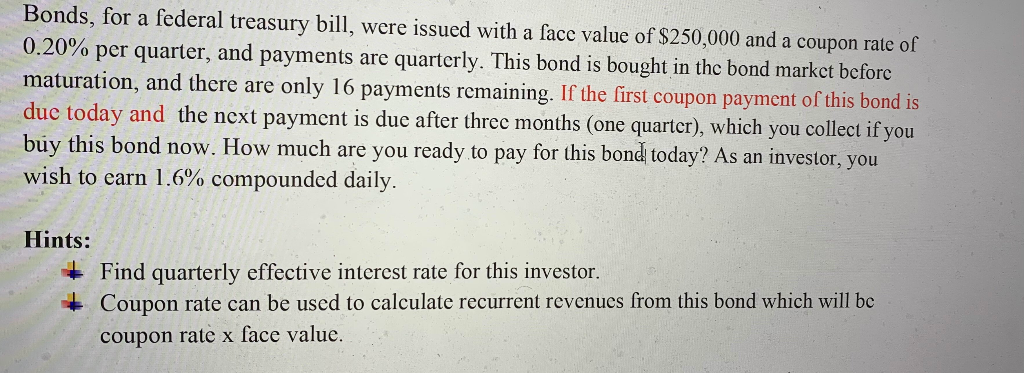

Treasury bill coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. 5 Year Treasury Rate - YCharts 21.06.2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.18%, compared to 3.14% the previous market day and 0.90% last year ... Treasury Bills - Guide to Understanding How T-Bills Work Jan 23, 2022 · In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

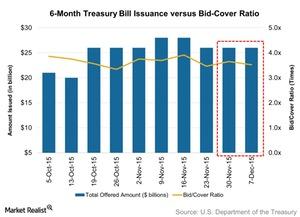

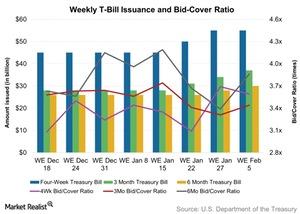

Selected Treasury Bill Yields - Bank of Canada Treasury bills. Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. Data available as: CSV, JSON and XML. Series. 2022‑05‑25. 2022‑06‑01. 2022‑06‑08. 2022‑06‑15. 2022‑06‑22. United States - Treasury Bills: 26-week - High rate Median rate (%) 50% of the amount of accepted competitive tenders was tendered at or below this rate. Low rate (%) 5% of the amount of accepted competitive tenders was tendered at or below this rate. Investment rate (%) Equivalent coupon-issue yield. Allotted at high (%) The fraction of the issue won by bidders paying the high rate. Price ($) Treasury Bills (T-Bills) Definition - Investopedia 02.06.2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... How Are Treasury Bill Interest Rates Determined? Aug 27, 2021 · The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... Individual - Treasury Bills In Depth 10.02.2021 · You can bid for a bill in two ways: With a noncompetitive bid, you agree to accept the discount rate determined at auction.With this bid, you are guaranteed to receive the bill you want, and in the full amount you want. With a competitive bid, you specify the discount rate you are willing to accept.Your bid may be: 1) accepted in the full amount you want if the rate you … Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

PDF Treasury Auction Results For Immediate Release CONTACT: Treasury Auctions June 21, 2022 202-504-3550 TREASURY AUCTION RESULTS Term and Type of Security 91-Day Bill CUSIP Number 912796U56 High Rate 1 1.670% Allotted at High 52.46% Price 99.577861 Investment Rate 2 1.700% Median Rate 3 1.640% Low Rate 4 1.400% Issue Date June 23, 2022 Maturity Date September 22, 2022 ...

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Statement by Secretary Yellen on President Biden ... - home.treasury.gov WASHINGTON - Today, at the G7 Leaders' Summit in Germany, President Biden and fellow G7 Leaders formally launched the Partnership for Global Infrastructure and Investment (PGII), a values-driven, high-standard, and transparent partnership to meet the enormous infrastructure needs of low- and middle-income countries without trapping them in cycles of debt. PGII will mobilize billions of ...

Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ...

How Is the Interest Rate on a Treasury Bond Determined? 05.02.2020 · But it also means that Treasury rates are comparatively modest. As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. That is a …

What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ...

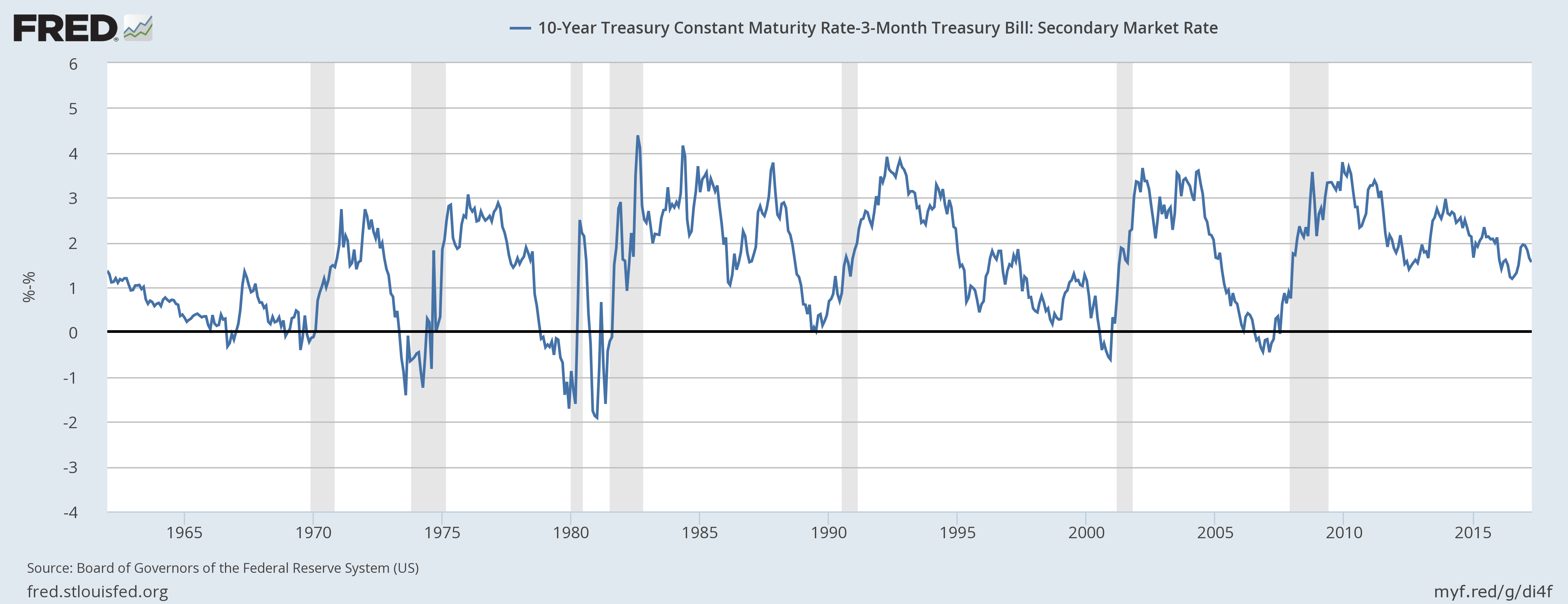

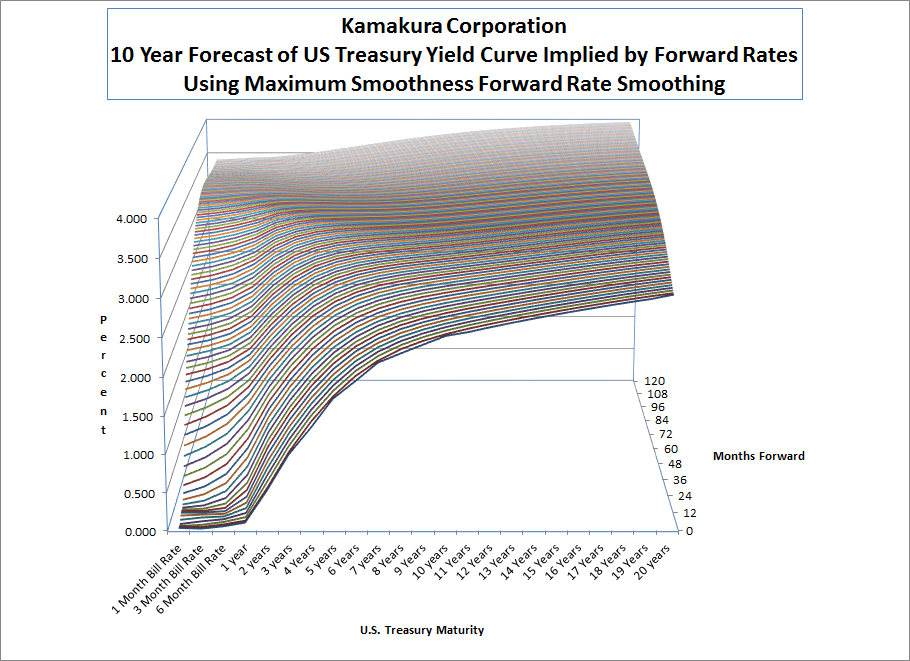

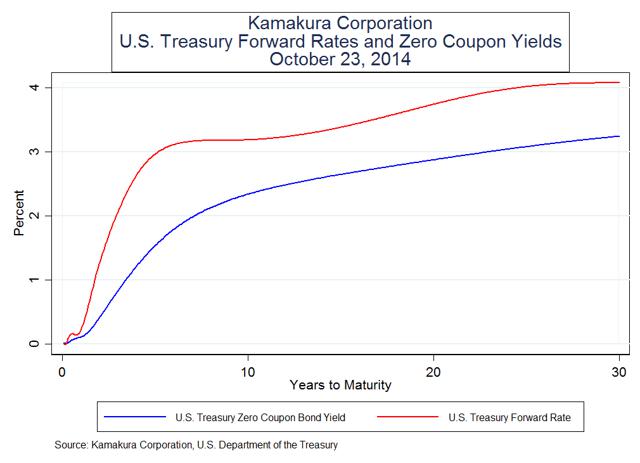

Weekly Forecast: Peak In 1-Month Forward Treasury Yields Drops 0.11% In the aftermath of the Fed's rate hike last week, Treasury yields settled in at a lower level, with the peak in 1-month forward rates down 0.11% for the week. The probability of an inverted ...

Treasury Bill Rates - NASDAQ - Datastore The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the...

Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Continue Reading Bill Terrell Investing for over 25 years.

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury rates. Home / Treasury and the Markets / Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 20 Jun 2022: 1803: 91 DAY BILL: 23.2462: 24.6805: 20 Jun 2022: 1803: 182 DAY BILL ...

Investing in Treasury Bills: The Safest Investment in 2022 A Treasury bill is any bond issued with a maturity of one year or less. Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as "Treasury bills" or "T-bills" or simply "Treasuries.") Treasury bills are seen as the safest bonds in the world ...

Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Post a Comment for "39 treasury bill coupon rate"