41 duration zero coupon bond

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange ... ZROZ 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund US Treasury Sector 1.64% distribution yield As of 03/31/2022 2.38% 30-day sec yield As of 05/12/2022 -26.45% nav ytd return As of 05/12/2022 -26.13% MARKET PRICE YTD RETURN As of 05/12/2022 Overview Fees & Expenses Yields & Distributions Prices & Performance Portfolio Composition PIMCO 25+ Year Zero Coupon US Treasury Index ETF This unique ETF offers investors an opportunity to access long-dated Treasuries, and is one of the most effective tools out there for those looking to dial up interest rate risk and extend the effective duration of a fixed income portfolio. ZROZ invests exclusively in STRIPS, the final principal payments of U.S. Treasuries with at least 25 years remaining until maturity.

Bond Duration - Understanding Interest Rate Risk Rules of Duration Now that we have an intuitive understanding of duration, below are the inferences can be made: For an interest paying bond, the duration will always be lesser than the maturity For a zero-coupon bond/non interest paying bond, the duration will equal the bond's maturity

Duration zero coupon bond

What is zero coupon bonds? - myITreturn Help Center Zero coupon bonds may be long or short term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. Duration and Convexity, with Illustrations and Formulas Therefore, Frederick Macaulay reasoned that a better measure of interest rate risk is to consider a coupon bond as a series of zero-coupon bonds, where each payment is a zero-coupon bond weighted by the present value of the payment divided by the bond price. Hence, duration is the effective maturity of a bond, which is why it is measured in ... What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

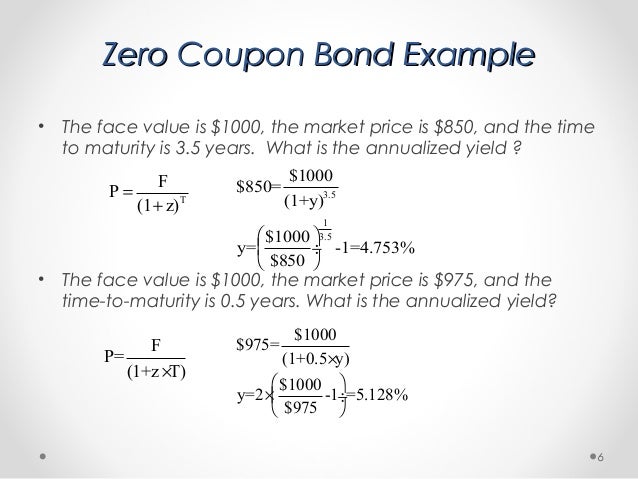

Duration zero coupon bond. What Is a Zero-Coupon Bond? Definition, Characteristics ... Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N... a. What is the duration of a zero-coupon bond that has six ... a. What is the duration of a zero-coupon bond that has six yearsto maturity? Duration of the bond= _____ years. b. What is the duration if the maturity increases to 7years? Duration of the bond= _____ years. c. What is the duration if the maturity increases to 8years? Duration of the bond= _____ years Advantages and Risks of Zero Coupon Treasury Bonds The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index... Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

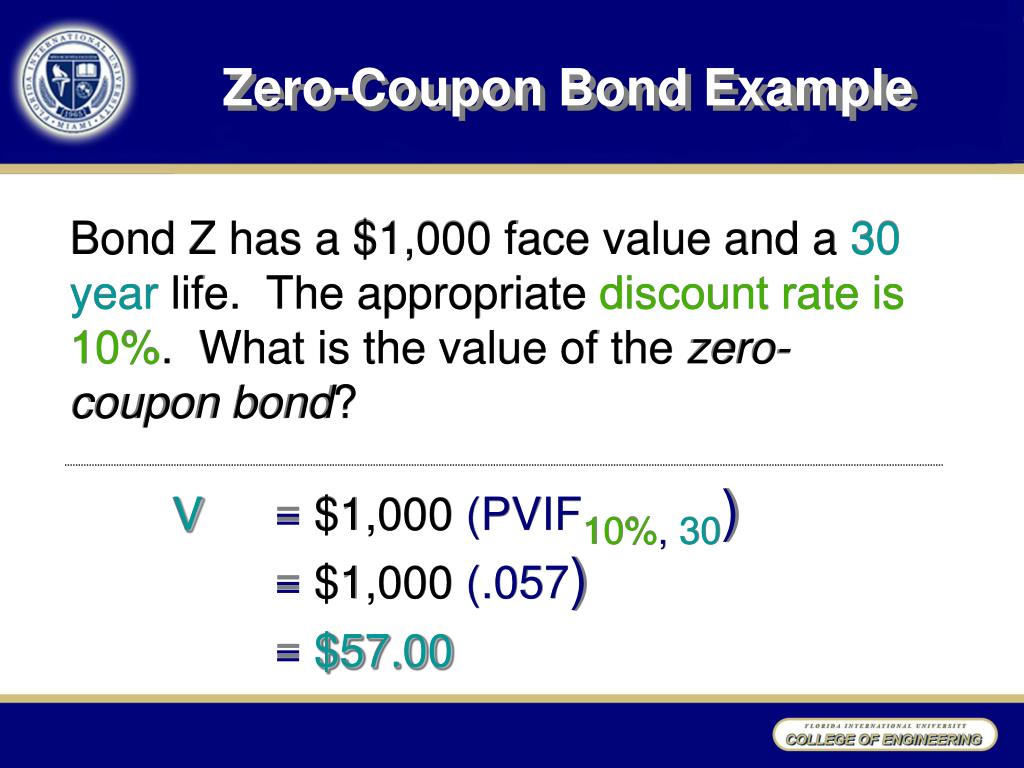

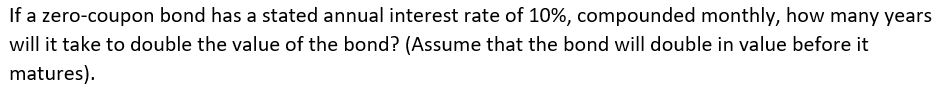

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ... Dollar Duration Definition Remember, 0.01 is equivalent to 1 percent, which is often denoted as 100 basis points (bps). To calculate the dollar duration of a bond you need to know its duration, the current interest rate, and... Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

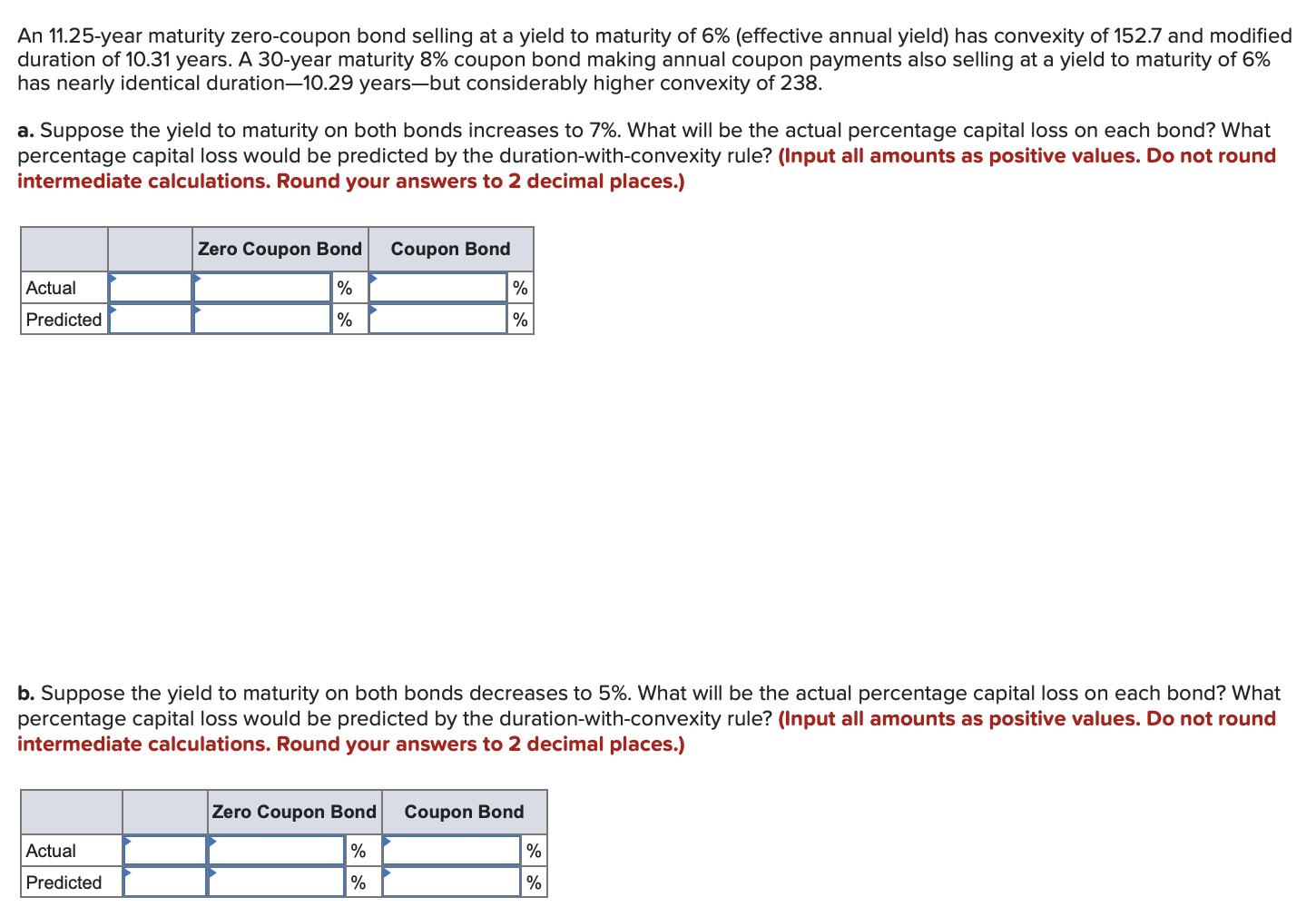

Zero-Coupon Bond Value | Formula, Example, Analysis ... The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations. What Are Zero Coupon Bonds? - Annuity.com Zero-coupon bonds have a duration equal to the bond's time to maturity, making them sensitive to any changes in the interest rates. In addition, investment banks or dealers may separate coupons from the principal of coupon bonds, known as the residue, so that different investors may receive the principal and each of the coupon payments. Duration and Convexity to Measure Bond Risk However, for zero-coupon bonds, duration equals time to maturity, regardless of the yield to maturity. The duration of level perpetuity is (1 + y) / y. For example, at a 10% yield, the duration of... Modified Duration Definition Macaulay Duration = Market Price of Bond∑t=1n (PV × CF)× t where: PV × CF = Present value of coupon at period t t = Time to each cash flow in years n = Number of coupon periods per year Here, (PV)...

Stenos Signals #7: Duration is getting killed across all ... In plain words the duration profile depicts the amount of years until the weighted average of expected cash flows are received by the investor in an asset. That calculation is straight forward for a zero-coupon bond as you simply receive the cash-flow when the bond matures, meaning that a 10yr zero coupon bond has a maturity of 10 years.

Your Money: How duration of a bond determines its degree ... Any bond which is traded before maturity, be it a plain vanilla coupon paying bond, or a zero-coupon bond, exposes the holder to price risk. Conservative investors should go for low to moderate...

Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

Duration Definition - investopedia.com The duration of a zero-coupon bond equals its time to maturity since it pays no coupon. Duration Strategies In the financial press, you may have heard investors and analysts discuss long-duration...

What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

Duration and Convexity, with Illustrations and Formulas Therefore, Frederick Macaulay reasoned that a better measure of interest rate risk is to consider a coupon bond as a series of zero-coupon bonds, where each payment is a zero-coupon bond weighted by the present value of the payment divided by the bond price. Hence, duration is the effective maturity of a bond, which is why it is measured in ...

What is zero coupon bonds? - myITreturn Help Center Zero coupon bonds may be long or short term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "41 duration zero coupon bond"